Customer profitability analysis is best conducted with a technique known as Activity based costing or ABC analysis. Customer profitability analysis helps the company understand the net profit coming from each customer which can be calculated by revenue less costs. These costs are not only manufacturing and distribution costs but also sales costs, marketing costs, services cost and any other related costs which have to be undertaken to service the customer.

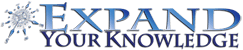

Once the costs are finalized, the customer can be classified into different profit tiers. This principle is best observed in the banking industry with credit card as a product. Customers are basically classified into four types

- Platinum customers – Most profitable

- Gold customers – Profitable

- Iron Customers – Low profit but desirable

- Lead customers – unprofitable and undesirable

Lets take credit cards themselves as an example. A credit card company would always give the best service as well financial and other benefits to the top two customers. It will at the same time try to attract iron customers and try to convert these iron customers to platinum or gold customers. Finally, these companies will have systems in place so as to avoid Lead customers completely.

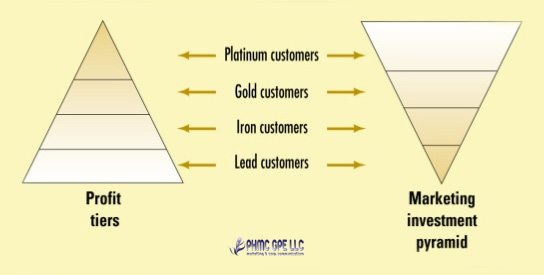

It is found that with customer profitability analysis, the firm can correctly classify customers and also find out which of the customers it needs to hold on to and acquire more of the same type, and which customers it needs to let go of. Several times, companies find out that there are customers which they should have left altogether as the profitability from these customers is minimum and expenses are more.

One of the major hindrance in calculating customer profitability analysis is to calculate cost. Calculating cost per customer becomes difficult especially in a service environment where manpower as well as time also has a cost factor associated with it. Time spent with each customer is different and therefore the cost is different. Furthermore there are several non customer related costs too such as the cost of lost customers. If the firm ignores these costs then the final cost will be not be the right figure thereby affecting the overall customer profitability analysis. The customers will be shown more profitable than they actually are.

Sources: PHMC GPE LLC - Marketing91 - Coffee Break - HO1.us